Bank from any where

Save paper, save trees

Spending pattern and ATM Usage

green passbook

Banking made easy ...

Next generation mobile banking passbook

- Δ

Bank from any where

- Δ

Easy to install and use

- Δ

Real-time transaction information

- Δ

Save paper, save trees

- Δ

Capability to be seamlessly integrated with all major core banking solutions

- Δ

Works in online & offline modes

- Δ

Personal accounting & bank product updates

- Δ

Email /SMS option of passbook

- Δ

Value added features like 'Spending pattern' and ATM Usage'

- Δ

Links all of the Bank Customer's bank accounts including savings, loan, credit and debit card and more, into one single passbook

TABLET ACCOUNT OPENING

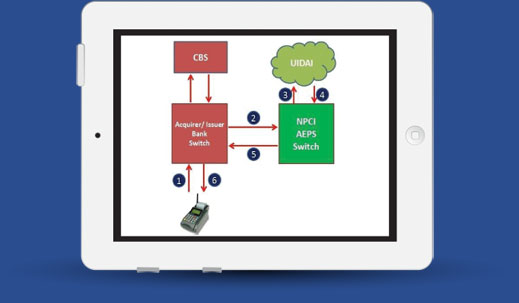

Financial Inclusion initiative

- Δ

Bank Account Opening while on the move

- Δ

BANK 3.0 - The next generation bank

- Δ

Two clicks to Know-Your-Customer authentication

- Δ

Can capture customer signature

- Δ

Works offline and online

- Δ

Photo capture of customer from the application

- Δ

Cash Acceptance and Receipt generation facility with micro printer

- Δ

Data can be directly transferred to core banking software through an approval process

- Δ

Bulk upload of data is available (suitable for institutions and corporate)

PAY TO MOBILE

Making money transfer quick and efficient

- Δ

Payment can be Initiated without Beneficiary Account Number

- Δ

Beneficiary can claim the payment by supplying the claim code and other details

- Δ

Unclaimed payment beyond a predefined cut off period, will be returned to Customers Account

- Δ

It is fast, secure and very convenient and it could be clubbed with many fringe benefits as well, as part of Bank's marketing initiative

- Δ

High level of security just like net banking